Identity theft has increased manifold. If companies don’t pay attention to this phenomenon, it can cause havoc. Other than stealing critical data, it can ruin an organization’s reputation and customer goodwill.

The Federal Trade Commission (FTC) received almost 1.4 million identity theft reports back in 2021. It states that customers lost over $5.8 billion due to identity theft in one year. The statistics only go to show why it is essential for organizations to execute reliable ID verification systems.

However, not many organizations are aware of the process of digital ID verification. In this article, we will shed light on the process and also how to address some challenges that exist here.

Understanding Digital ID Verification

The process of identity verification is a common phenomenon through physical transactions, such as a cashier asking to check the consumer’s driver’s license to authenticate those who are eligible to buy alcohol. It is also possible for people to confirm their identity when they contact their financial institution to initiate transactions.

Here, the concerned people might have to prove their identity to accomplish the job at hand. The process of digital verification shifts this entire process from the physical world by enabling consumers to validate their identity online by providing a certain set of data, lists, and reports.

Standard Challenges of Digital ID Verification

Digital identity verification can lead to a set of challenges, the majority of which include privacy concerns, inconveniences, or heightened security problems. It is necessary to address them so that there is an improved customer experience where the users can confirm their identity.

The common problems include:

Inconvenient, Sluggish, and Manual Procedures

In the banking sector, a time-consuming verification process can make users frustrated. Some people might not complete the verification process, despite opening their account. For instance, some consumers always complain and move out of the 2FA owing to the trouble it causes.

Manual reviews can lead to delays. On the other hand, regular manual interventions aimed at ensuring verification precision can get tiring for both institutions and customers. There are a few banks that might need physical visits for manual reviews, which add challenges, maximize the cost, and can also make companies lose out on customers.

All these problems prove that there is a need for an ID verification process to secure customers and reduce the inconvenience as much as possible.

Security Issues

Any digital ID verification will ask for sensitive data from users. There is a risk attached to this. If your verification process is poorly designed, it can result in identity fraud. If cybercriminals manipulate or bypass the verification procedure or steal ID documents, they can take on another identity, thereby resulting in unauthorized access, reputational damage, and financial loss.

Hence, the digital ID verification service you choose must secure sensitive customer data. When privacy concerns get neglected, it can erode trust, and cause data breaches and other legal complications. You need to implement strict security measures and best practices.

Challenges With User Experience

Complicated verification procedures can overwhelm and confuse users, thereby resulting in frustration. Users who struggle to have a clear understanding of the requirements will not adhere to the process. Hence, you need to choose a service provider whose ID verification solution is more intuitive.

Additionally, technical challenges such as slow load times and system errors can completely affect user experience. All these problems indicate that your IT team should say yes to an error-free verification process.

AU10TIX states that prominent service providers in this niche are coming up with solutions that assist global digital wallets. It includes driving licenses, IDs, and resident permit networks to ensure secure and seamless onboarding.

How To Avoid These Challenges?

If you want to avert the problems listed above, you need to exercise prevention. Here are a few ways of how to go about it.

Streamlining the Verification Process

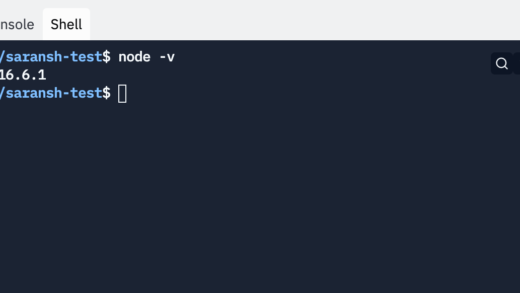

API integration and real-time data authentication with ID documents issued by the government can minimize the verification time. All these integrations allow instant validation, thereby making sure that there is a hassle-free onboarding experience.

After that, you need to reduce the manual interventions with technology such as automated document authentication. Intelligent algorithms conduct automated reviews and checks to reduce errors. A good objective is to keep manual interventions as an exception instead of the rule.

Improving Security

You need to manage the security issues. MFA (Multi-Factor Authentication) is a potent tool for improving security. By combining the password, smartphone, and biometric data, the MFA makes the security process more robust than ever. It can bring down the identity fraud risk, even when a single factor is weak.

The other option here is the blockchain, which provides a tamper-proof and secure way to carry out digital ID verification. By recording the confirmation transactions on the decentralized ledger, this technology averts all unauthorized changes and improves security. It is especially valuable for managing and storing online identity documents carefully.

Enhancing User Experience

A user-friendly interface can make a vast difference. Make sure that the ID verification procedure is simple, with distinct instructions and fewer steps. Make use of visual cues and feedback to guide the users through the process. You might also want to integrate chat assistance or even get a help center where users can opt for real-time guidance.

In conclusion, in today’s digital era, where there are several data points and probable threats, it is essential to invest in secure and robust digital ID verification solutions. The process will bring its own set of advantages and challenges as well. As you reap the benefits and come across the problems mentioned above, you can take necessary actions to avert them as well.