The first and most natural question for a novice crypto investor is: where to buy your first cryptocurrency. The answer is extremely simple: on a cryptocurrency exchange. Of all the options currently available for purchasing digital money, this is the easiest, most reliable and safest way.

Cryptocurrency trading platforms are designed to handle a variety of digital asset transactions, including buying, selling, and exchanging coins. Their functionality includes the creation of both simple and complex orders, as well as the ability to store funds in the account, deposit and withdraw funds. In addition, each platform may offer additional options associated with its unique features, such as landing, staking, futures, margin trading, native token, trading bots and others.

What are the cryptocurrency exchanges?

Cryptocurrency trading platforms are divided according to several key characteristics:

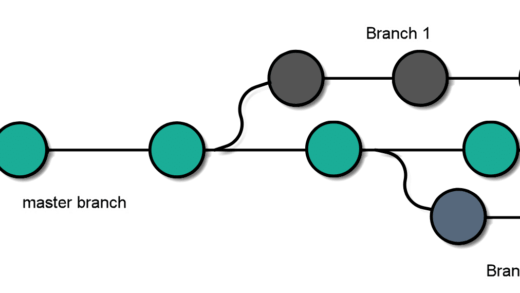

- Centralized and decentralized. Centralized exchanges (CEEXs) are operated by a company that provides trade execution, order matching, and other functions. They have a built-in multi-currency crypto wallet. Swap USDT-TRC20 to USDT-TRC20 is performed unnoticed by the user. You will simply need to indicate the desired network when transferring coins to any third-party wallet. Decentralized exchanges (DEXs) are not intermediaries and provide users with the technical ability to conduct transactions directly.

- Adjustable and unregulated. Regulated platforms follow the laws of their country of incorporation, providing information about users and transactions when requested by authorities. Most of the large CECs belong to this group. Unregulated exchanges focus on greater privacy.

- With or without KYC/AML verification. Some exchanges require users to provide personal information (KYC), including passport details and selfies. Others allow you to trade without verification, but with restrictions. These restrictions may apply to transaction volume, deposit method, withdrawal amount and crypto-fiat transactions.

- Spot or derivative. Spot exchanges provide instant settlement of trades. Derivatives platforms perform settlements at a specified time using derivative contracts such as futures and options. Most large CEXs can be defined as derivatives.

- Fiat or cryptocurrency. DEX and some CEX only allow the exchange of cryptocurrency. But many CEKS support the deposit and withdrawal of fiat funds, while requiring identity verification.

- P2P platforms. Peer-to-peer cryptocurrency trading platforms facilitate interaction between users, allowing them to choose the terms of a trade or create their own listings. Settlements occur directly between participants without the participation of the platform.

What to look for when choosing a crypto exchange

When choosing a cryptocurrency trading platform, it is recommended to consider the following key criteria:

- Regional support. Make sure the site you choose supports your region. Some exchanges restrict access in certain jurisdictions.

- Trading goals. Who do you want to be first: an investor or a trader? Are you planning to buy coins, and are you willing to wait several years until they rise in price several hundred times? Or are you more attracted to short-term transactions and making money on changes in the exchange rate of BCN to BTC and other coins? In the first case, you can choose a reliable spot platform with fiat support or buy coins from an exchanger. The trader will need more options.

- Payment methods. Check the available deposit and withdrawal methods and make sure that among them there are ones that are convenient for you. An effective choice of payment methods helps you avoid unnecessary fees and delays.

- Supported assets. Find out which cryptocurrencies the platform supports. In some places the choice is limited to a few dozen coins, in others the number of available assets is in the hundreds.

- Trading with leverage and futures. If you are interested in trading with leverage or futures, make sure that the exchange you choose offers the appropriate options. This method of earning money can bring greater profits, but the risks of losses increase in the same proportion. This market requires experience and risk management skills.

- Safety. Evaluate the platform’s security measures, including the storage of funds and available two-factor authentication options. Account security should be a priority.

Considering these factors will help you choose the cryptocurrency platform that best suits your crypto trading needs and goals.